Developing Leaders Within Private Equity Portfolio Companies

Drinking from the money fountain

Over the last five years, the private equity industry has experienced tremendous growth; a sustained period of low interest rates has made it very attractive to investors. As a result, the money raised by private equity firms has grown substantially, and the largest funds in history have been created and focused on global opportunities. At the same time, there are not as many easy targets in the market. This smaller number of solid available opportunities command higher prices—and a higher price at entry naturally makes it harder to achieve an attractive return on exit, driving a shift in focus from finding lower-priced assets to experimenting with methods of creating stronger returns.

To achieve the level of returns demanded by investors, holding periods are increasing. Several large private equity firms have launched funds with longer lives than have previously been the norm. One particular firm raised $5 billion for a fund with holding periods that are expected to be around twice as long as those of traditional buyout funds. As a result, value creation over the long term becomes the most important driver, and investors will favor firms that can create genuine value through the transformation of companies in their portfolio, and not only through clever, short-term financial engineering. Being smarter about leadership is one way to create value. Doing this requires a shift in the relationship between private equity professionals and portfolio company CEOs. This is particularly true when it comes to the ways in which operating partners help portfolio companies take a longer-term approach to managing leadership talent.

Changed thesis, changed context, same leaders?

The shift in ownership brings with it a significant change to the context and drivers of success for the portfolio company: moving from being family-owned, moving from being an organization conceived and created by an entrepreneurial innovator, moving from being carved out of a larger global multinational, or moving from a stand-alone company to a merged entity. All such moves bring a shift in approach, and a change in leadership is needed to make them successful as organizations.

Private equity investment professionals invest a lot of time and attention in developing and managing relationships with portfolio company CEOs and management teams. They are increasingly focused on the value they can add in helping CEOs by using their networks and facilitating access to M&A targets. When it comes to adding value to leadership, private equity firms have become very adept at doing the due diligence of CEOs and CFOs and perhaps at looking in depth at particular aspects of the business. Deal makers, however, are less focused when it comes to understanding whether the company has the right leaders to take the organization to the next level and the role they can play in the longer-term transformation of the company. This highlights a real opportunity for operating partners to help portfolio company CEOs look deeper into their organizations to ensure that there is a robust pipeline of future leaders who can continue to take the company in the right direction and achieve the investment thesis over the long term. This goes beyond looking at how many people have potential and instead identifies those who have what it takes to lead at greater scale, be it at a larger organization, in a more complex operation, or over a more diverse geographical spread.

How private equity-focused professionals can help

As an investor for the longer term, how can private equity-focused professionals contribute? The relationships with the portfolio company require a balance in focus between achieving goals that create long-term value and avoiding too much day-to-day interference. That said, here are some questions portfolio company CEOs should be encouraged to consider:

- Are you looking at the strength and depth of talent the way you are looking at the financials?

- Do you have the right talent in the right places to execute the investment thesis successfully?

- Is the organization generally set up to scale? What systems and processes need to be added or taken away to support getting to and succeeding at greater scale?

- Is the current culture and ways of working helping or hindering future success, and do you have the right leaders who will not only be role models for the future way of working, but will create the kind of environment around themselves that will drive long-term success?

- Do you have a sense of the strengths and gaps in your talent pipeline when it comes to meeting the specific challenges for the future and positioning the organization for longer-term success?

- Do you know how many of your leaders are ready to take on the challenges of increasing scale and complexity, and do you know where they are now?

- If so, how are you defining talent? How does it add value to the company?

- And finally, how are you developing the capacity to drive even further growth?

As achieving returns on investments becomes more difficult and holding periods become longer, private equity firms can benefit from being smarter about leadership. They can recognize that added value can be achieved by looking beyond current leadership to develop the next generation of leaders who can turn a longer-term investment thesis into daily action and tangible returns.

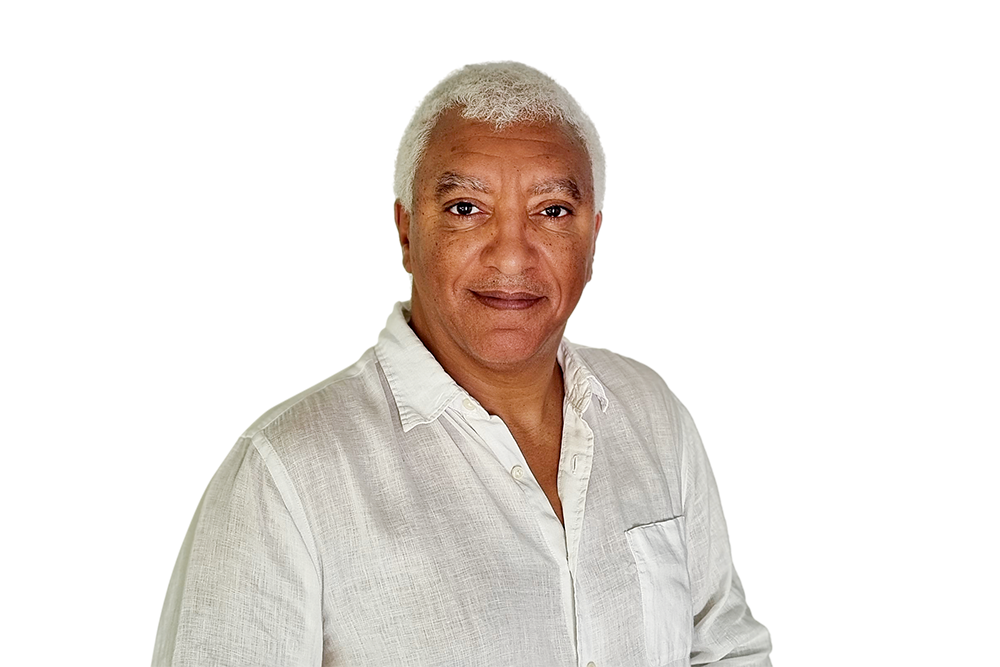

To find out how RHR International’s Executive Bench® services can help your organization plan for critical leadership transitions, contact Jessica Foster.

![]()